The 3 Key Questions

There are three questions to ask any college when it comes to possible need-based financial aid:

1. Will the college or university meet 100% of your demonstrated need beyond your Expected Family Contribution (EFC) under the Federal Methodology?

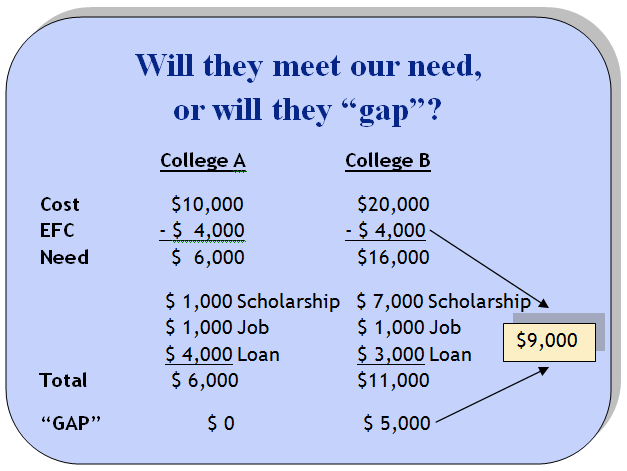

College A does in the example below, but College B leaves the student with a $5,000 “gap” in unmet need. College B just made the cost to this family $9,000—the $4,000 the federal EFC is calling for and the $5,000 College B didn’t give this family.

Tip: Just because the Federal Methodology gives you an EFC, it doesn’t mean every college can honor the calculation and fully fund your financial need.

2. Does the college or university make any changes in the Federal Methodology in figuring student need for institutional financial aid awards?

When colleges make changes to the Federal Methodology, we call it an Institutional Methodology (IM). Note: These adjustments will affect only potential aid from the college (not federal or state grants).

Here are some of the more common IM adjustments to the Federal Methodology that may lead to the college, in effect, increasing your EFC and perhaps decreasing your institutional aid:

- Collecting income and asset information from a non-custodial parent to see how much, if any, he or she is capable of providing for their child’s education

- Home equity (the net worth of the home, i.e., its current value minus any debt against it)

- Retirement accounts that might be borrowed against

- 529 College Savings plans set up for the student that are owned by someone besides the student or parent(s)

Tip: You need to find out if a college makes any adjustments to the Federal Methodology that could add to your EFC and potentially reduce your need-based aid eligibility.

3. What will your financial aid award contain?

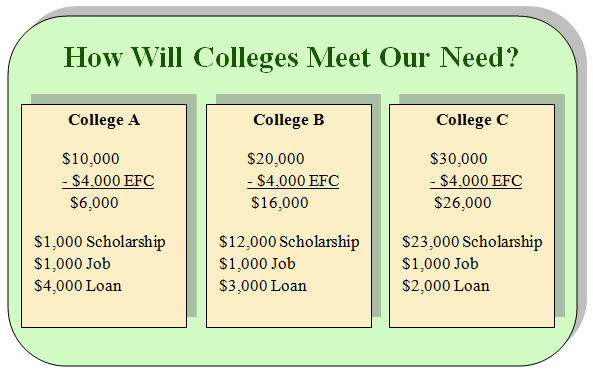

Look at how the student is funded in the example below. Which is the best offer?

Answer: Clearly College C has made the best offer with only $2,000 in student loan debt.

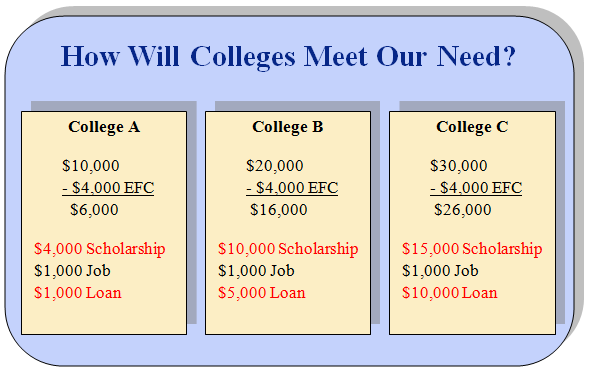

But what if these three colleges instead fund the student like in the example below? Which is the best offer?

Answer: Clearly it is College A with only $1,000 in student loan debt for the first year; College C potentially has this student headed for $20,000 in loan debt for a two-year degree and $40,000 for a four-year degree.

Tip: You need to get some idea about a college’s tendency to give scholarships and/or grants versus educational loans. To get your EFC and an early estimate of the kind of financial aid package you might receive given your current financial figures and academic record, click here.